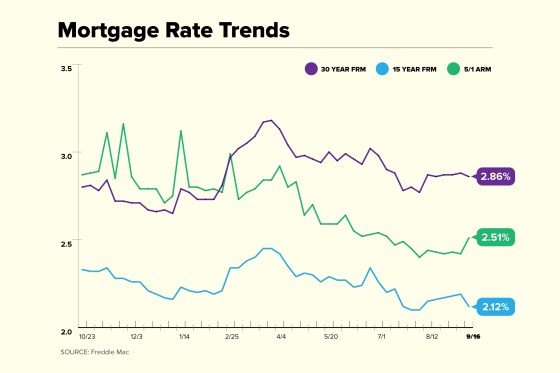

The 30-year fixed-rate loan is averaging 2.86% for the week ending September 16, down just 0.02 percentage points from last week, according to Freddie Mac’s benchmark survey.

Rates have been hovering between 2.86% and 2.88% since August 12. Earlier this year, there was more weekly movement, with the 30-year rate reaching a high of 3.18% on April 1. Since then, rates have been trending lower with occasional bumps.

“It’s Groundhog Day for mortgage rates, as they have remained virtually flat for over two months. The holding pattern in rates reflects the markets’ view that the prospects for the economy have dimmed somewhat due to the rebound in new COVID cases,” said Sam Kahet, Freddie Mac’s chief economist. “While our collective attention is on the pandemic, fundamental changes in the economy are occurring, such as increased migration, the extended continuation of remote work, increased use of automation, and the focus on a more energy-efficient and resilient economy. These factors will likely lead to significant investment and new post-pandemic economic models that will spur economic growth.”

Not sure how much house you can afford? Talk to a mortgage expert today before the market changes!

Mortgage experts can help you find the best financing option for your needs, to help you get one step closer to the home of your dreams. Click your state to begin!

The direction of rates for various types of loans continues to be mixed this week:

- The current rate for a 30-year fixed-rate mortgage is 2.86% with 0.7 points paid, down 0.02 percentage points from a week ago, and down just 0.01 percentage points from a year ago, when the rate averaged 2.87%.

- The current rate for a 15-year fixed-rate mortgage is 2.12% with 0.6 points paid, 0.07 percentage points lower than last week. A year ago, the 15-year rate was 2.35%.

- The current rate on a 5-year adjustable-rate mortgage is 2.51% with 0.1 points paid, an increase of 0.09 percentage points week-over-week. A year ago, the 5/1 ARM rate was 2.96%.

Mortgage Rate Trends

Will current mortgage rates last?

Mortgage rates have been in a holding pattern for a little over a month. The rise of the Delta variant of the COVID-19 virus has put a damper on the economic recovery and counteracted some of the positive developments that could have pushed rates higher the last few weeks.

This pattern may soon change, however, as COVID infections seem to be plateauing. On the economic front, retail sales, which had been expected to decline, saw a nearly 1% increase in August, which is good news for the economy. On the other hand, Inflation, meanwhile, was a little lower than expected last month.

Why does this matter?

The Federal Reserve has based decisions around tapering its accommodative monetary policy on the strength of the labor market and the economic recovery. The Fed’s position has been that inflation, which is currently over 5% and above the central bank’s target rate of 2%, is temporary. If inflation continues to slow down and other economic indicators, such as employment and retail sales, continue to improve, it could push the Fed to a more aggressive stance on its policy. For now, all eyes will be on the Fed’s upcoming September meeting.

“The fact that interest rates haven’t moved much in recent weeks indicates that investors are still waiting for more certainty,” said Matthew Speakman, senior economist at Zillow. “All told, there’s a good chance that mortgage rates will move notably in the coming weeks, but the jury’s still out on which direction they’ll head.”

On Thursday, the yield on the 10-year Treasury note opened at 1.304%, unchanged from yesterday’s close. However, yields rose 0.03 percentage points earlier this morning after a better than expected retails sales report for the month of August. There tends to be a spread of about 1.8 percentage points between the 10-year Treasury and average mortgage rates.

Are mortgage rates impacting home sales?

The number of mortgage applications ticked up 0.3% for the week ending September 10, according to the Mortgage Bankers Association. The increase takes an adjustment for the Labor Day holiday into consideration.

- Purchase applications were up a seasonally adjusted 8% from the previous week and 12% lower than the same week last year. On an unadjusted basis, purchase loan volume was 5% lower week-over-week.

- Refinance applications also ticked lower, decreasing 3% from the week prior and 3% lower than the same week last year. Refinancing continued to slow as the share of refi applications dropped to 65% of all applications, the lowest total since July.

Money Moves

Every Saturday, Money real estate editor Sam Sharf dives deep into the world of real estate, offering a fresh take on the latest housing news for homeowners, buyers and daydreamers alike.

Why your mortgage rate may be higher than current mortgage rates

Not all applicants will receive the very best rates when taking out a mortgage or refinancing. Credit scores, loan term, interest rate types (fixed or adjustable), down payment size, home location, and the loan size will affect mortgage rates offered to individual home shoppers.

Rates also vary between mortgage lenders. It’s estimated that about half of all buyers only look at one lender, primarily because they tend to trust referrals from their realtors. Yet this means that they may miss out on a lower rate elsewhere.

Last year, Freddie Mac reported that buyers who got offers from five different lenders averaged 0.17 percentage points lower on their interest rate than those who didn’t get multiple quotes. If you want to find the best rate and term for your loan, it makes sense to shop around first.

Today’s mortgage rates and your monthly payment

More than other factors, your annual percentage rate on your real estate purchase will affect your monthly payments — whether you’re refinancing or buying a new home.

On a $200,000 home loan with a fixed rate for 30 years:

- At 3% interest rate = $843 in monthly payments (not including taxes, insurance, or HOA fees)

- At 4% interest rate = $955 in monthly payments (not including taxes, insurance, or HOA fees)

- At 6% interest rate = $1,199 in monthly payments (not including taxes, insurance, or HOA fees)

- At 8% interest rate = $1,468 in monthly payments (not including taxes, insurance, or HOA fees)

Refinancing to a lower interest rate could save hundreds of dollars a month if you kept the same loan terms. Shortening the loan term could negate your monthly savings but save thousands over the life of the loan. You can experiment with a mortgage calculator to find out how much a lower rate could save you.

Other factors besides interest affect how much you’ll pay in mortgage payments:

- Mortgage Insurance: Mortgage insurance costs up to 1% of your home loan’s value to your payment each year. Borrowers with conventional loans can avoid private mortgage insurance by making a 20% down payment or reaching 20% home equity. FHA borrowers pay a mortgage insurance premium throughout the life of the loan.

- Closing Costs: Some buyers finance their new home’s closing costs into the loan, which adds to debt and increases monthly payments.

- Loan Term: Choosing a 15-year mortgage instead of a 30-year mortgage will increase monthly mortgage payments but reduce the amount of interest paid throughout the life of the loan.

- Fixed vs. ARM: An adjustable-rate mortgage’s monthly payment could change from year to year after the loan’s introductory period expires. A fixed-rate loan’s payments remain the same throughout the life of the loan.

- Taxes, HOA Fees, Insurance: A monthly mortgage payment could also include homeowners insurance premiums, city or county property taxes, and Homeowners Association fees. Check with your real estate agent to find out how much they would add to your payments.

Will current mortgage rates save you money if you refinance?

You should consider refinancing your home loan if your current mortgage rate exceeds today’s mortgage rates by more than one percentage point. Mortgage refinance fees and closing costs would cut into your savings. You also have to consider whether your credit score would qualify you for today’s best refinance rates.

Many online lenders can give you free rate quotes to help you decide whether the money you’d save in interest charges justifies the cost of a new loan. Try to get a quote with a soft credit check which won’t hurt your credit score.

You could enhance interest savings by going with a shorter loan term such as a 15-year mortgage. Your payments may be higher, but you could save thousands in interest charges over time, and you’d pay off your house sooner.

Want to lower your mortgage payments? Refinancing can help!

Refinancing your mortgage has never been easier and with interest rates near all-time lows, now may be the perfect chance to explore your options. Click below to learn more.

Should you buy mortgage points?

Many lenders sell mortgage points (also known as discount points). Buying points means you’d pay more up front to lower your mortgage rate which could save you money long-term. A mortgage discount point normally costs 1% of your loan amount and could shave 0.25% off your interest rate.

With a $200,000 mortgage loan, a point would cost $2,000. Buying two points would cost $4,000 which would be due, in cash, when you close the loan. These two discount points would translate into a 0.5% reduction to your interest rate.

Discount points could pay off but only if you keep the home loan long enough. Selling the home or refinancing the mortgage within a couple of years would short circuit the discount point strategy. But if you stayed in the loan indefinitely, you’d reach a break-even point after which the discount points would save you more and more over time.

Often, spending cash on a down payment instead of discount points saves more unless you know for sure you’re keeping the loan for years. If a larger down payment could help you avoid paying PMI premiums, put the money toward your down payment instead of discount points.

How to find the best mortgage lender

The best mortgage lender for you will be the one the can give you the lowest rate and the terms you want. Your local bank or credit union probably writes mortgage loans with rates close to the current national average. A loan officer in your local branch could guide you through the process.

Online lenders have expanded their market share over the past decade. You could get pre-approved within minutes. Your loan amount combined with current mortgage rates could define your price range for home prices in your area. Many online lenders also assign a dedicated loan officer to offer continuity as you shop.

Shop around to compare rates and terms, and make sure your lender has the loan option you need. Not all lenders write USDA-backed mortgages or VA loans, for example. If you’re not sure about a lender’s veracity, ask for its NMLS number and search for online reviews.

What type of mortgage do you need?

First-time homebuyers can walk into a mortgage brokerage office or visit an online lender without knowing what kind of mortgage they need. But it’s always better to have an idea of what you’re shopping for, especially since you can’t control other factors such as home prices and current rates.

Mortgage loan types include:

- Conventional Borrowing: Shoppers with higher credit scores and higher down payments can get a conventional mortgage with either a fixed or adjustable rate. Mortgage interest rates can be low for qualified buyers.

- Subsidized Borrowing: The Federal Housing Administration and the U.S. Department of Agriculture help first-time homebuyers and shoppers in low-income areas buy homes by subsidizing their mortgage loans. FHA and USDA loans allow shoppers with lower credit profiles (a FICO score of 580) to still get affordable home financing. Subsidized loan restrictions include borrowing maximums and safe housing inspections. These loans are for single-family homes in most cases.

- Veterans Affairs Loans: Veterans and active-duty service members can buy homes with no down payment and no PMI through the Department of Veterans Affairs’ lending program. Banks make loans that are guaranteed by the VA. VA loans require a funding fee that could range from 1.4% to 3.64% for first-time homebuyers.

- Jumbo Loans: Homes in high-value housing markets like San Francisco and New York City may not fit within a conventional or FHA loan. Jumbo loans can help because they exceed the conforming loan limits of Fannie Mae and Freddie Mac.

Buying a new home just got a lot easier with Better.

Who said buying a home has to be difficult? Mortgage experts can guide you with the most important information. Click below and start consulting today.

More from Money:

Want to Refinance Your Mortgage This Month? Do These 7 Things Now

© Copyright 2021 Ad Practitioners, LLC. All Rights Reserved.

This article originally appeared on Money.com and may contain affiliate links for which Money receives compensation. Opinions expressed in this article are the author’s alone, not those of a third-party entity, and have not been reviewed, approved, or otherwise endorsed. Offers may be subject to change without notice. For more information, read Money’s full disclaimer.

"current" - Google News

September 16, 2021 at 10:30PM

https://ift.tt/3CjPTN3

Current Mortgage Rates Tick Lower - Crossroads Today

"current" - Google News

https://ift.tt/3b2HZto

https://ift.tt/3c3RoCk

Bagikan Berita Ini

0 Response to "Current Mortgage Rates Tick Lower - Crossroads Today"

Post a Comment