Tax Collections $4.4 Billion Higher Than Predicted By 2023

Senate Republicans: Once-In-A-Generation Opportunity To Fundamentally Reform Tax Code

2021-23 State Budget Projected To End With A $5.87 Billion Surplus, Up From $2.08 Billion

Estimated $808 Million Transfer To Rainy Day Fund For A $1.57 Billion Balance

June 8, 2021

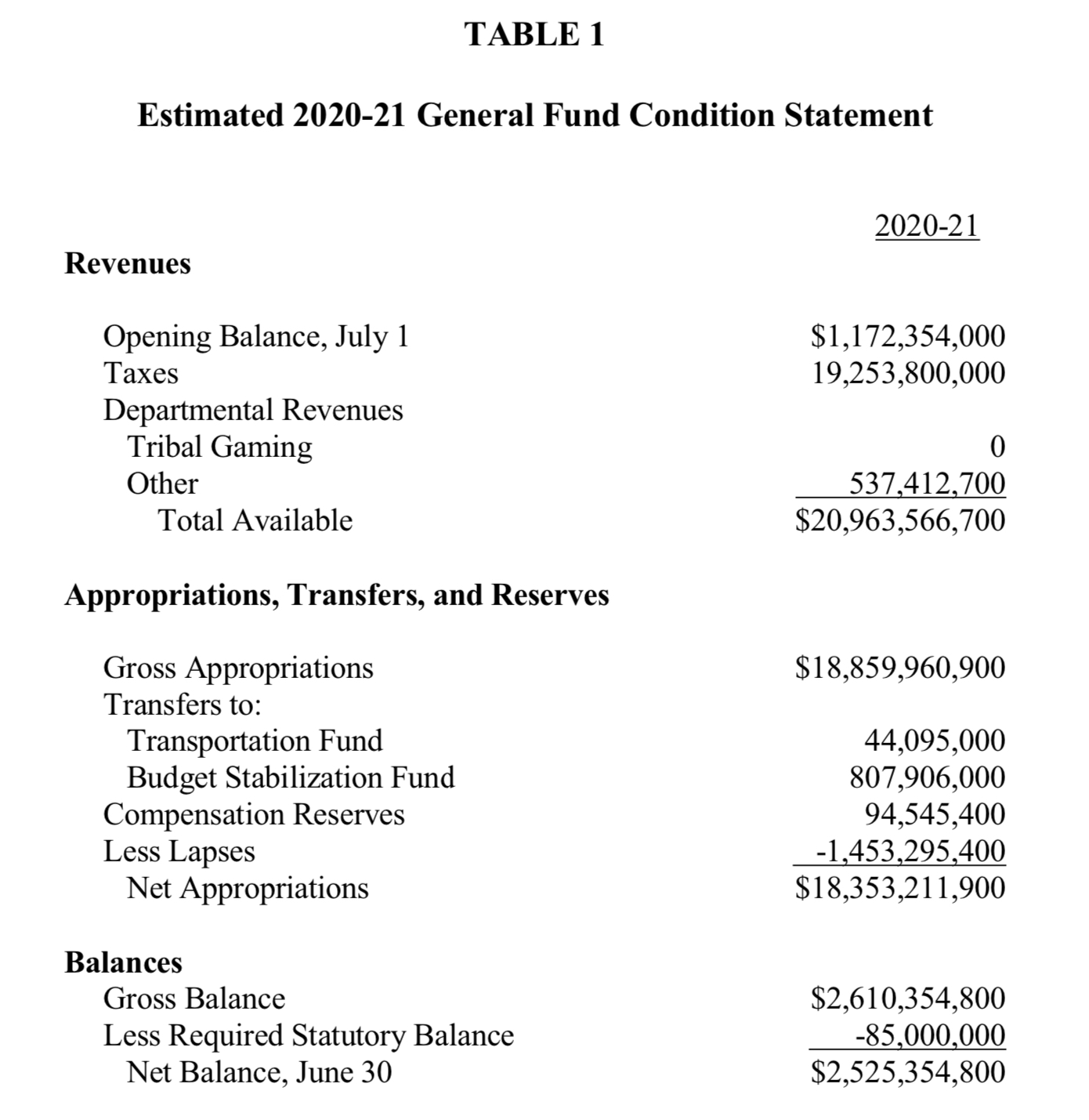

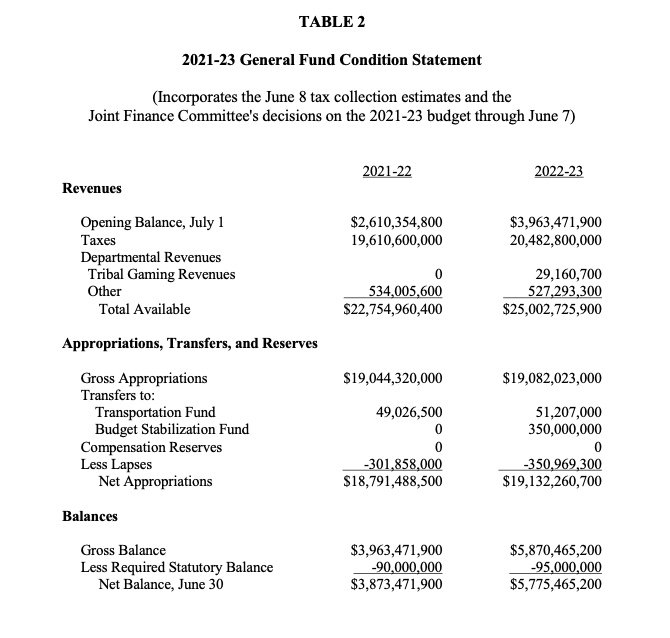

An updated revenue estimate released today shows that the State of Wisconsin is now expected to finish the current fiscal year (FY) with a $2.6 billion surplus and an even bigger $5.87 billion surplus by the end of the 2021-2023 budget, thanks in part to an “unprecedented” $4.4 billion more in tax collections, which is an 8.1% increase over a previous estimate. This incredible fiscal news is “based upon the strength of collections and the vastly improved economic forecasts for the reminder of this year and the next two years,” according to the nonpartisan Legislative Fiscal Bureau (LFB).

Of the $1.4 billion surplus that LFB estimates state government will end FY21 with, which is at the end of June, $808 million will be transferred to the state Budget Stabilization Fund, better known as the Rainy Day Fund. This will bring the Fund’s balance to $1.57 billion by the end of the month.

With the higher than anticipated tax collections, LFB now estimates that the 2021-2023 state budget will end with a $5.87 billion positive general fund balance. The budget was originally projected to end with a $2.08 billion balance.

These “unprecedented” tax collection numbers appear to be caused by a combination of Wisconsin’s post-pandemic recovery from the government shutdown of our economy and the massive influx of federal COVID-19 stimulus money, specifically from the newly enacted American Rescue Plan Act (ARPA).

Following LFB’s release of the fiscal reestimate, Governor Tony Evers and Legislative Republicans announced their plans for the surplus.

“With so much money already flowing into Wisconsin from the federal government, this additional revenue gives us an opportunity to invest in the state’s priorities and to cut taxes for hard working families,” says Assembly Speaker Robin Vos (R-Rochester). “Shortly, our caucus will discuss those priorities and move forward on lowering the income and property tax burden on Wisconsin businesses and families.”

“This is a once-in-a-generation opportunity to fundamentally reform our tax code and provide transformational tax relief for Wisconsinites,” says Senate Majority Leader Devin LeMahieu (R-Oostburg). “Hard-working taxpayers gave the state a massive surplus. We will take this moment to consider ways to significantly reduce the tax burden on workers and main street businesses and pay off state debt to save taxpayers long into the future.”

“I’m proud of the work we’ve done to respond to COVID-19 and put our economy in the best position to recover,” Governor Evers says, “which is why there’s no excuse for choosing not to fully invest in our kids and our schools, broadband, venture capital and support for Main Street businesses, among other critical priorities.”

Member of the Joint Finance Committee (JFC) Senator Duey Stroebel (R-Saukville) says, “With this new surplus, Republicans want real, substantial tax relief that keeps less money in Madison and more money in the hands of working families and main street employers.”

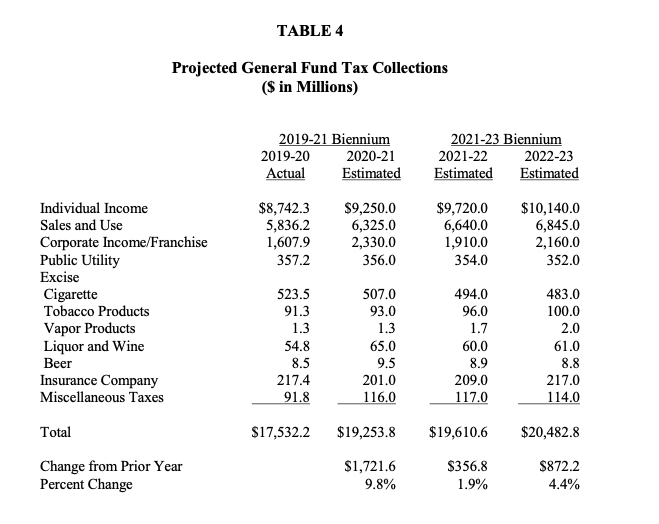

The $4.4 billion tax collection surplus is expected to come, in part, from a $2.58 billion, or 5.8%, increase in individual income tax collections. That comes in large part from a 6.02% increase in individual income withholding taxes from people getting back to work. The increase is also a result of individuals’ increased income from receiving federal COVID-19 stimulus checks.

By the end of FY23, sales taxes are expected to be up $990 million, or 8.4%, and corporate and franchise taxes are expected to be up $861 million.

JFC Co-Chair Howard Marklein (R-Spring Green) warned that this quick rebound of Wisconsin’s finances post-COVID-19 pandemic, “underscores the need to be cautious with this budget. If we recklessly spend this new money and grow taxpayer obligations in an unsustainable way, we risk future fiscal stability.”

“Assembly Republicans will continue to advance a reasonable, responsible and realistic budget that spends within our means, while also avoiding huge tax hikes on Wisconsin residents and businesses and welfare expansion like Evers proposed,” says JFC Co-chair Mark Born (R-Beaver Dam). “The budget- writing committee will work in the days and weeks ahead to deliver meaningful tax relief where it counts most.”

MacIver will continue to post updates as deliberations unfold.

"current" - Google News

June 09, 2021 at 02:40AM

https://ift.tt/3zfo8V0

Budget Blog: “Unprecedented” Tax Collections Give Wisconsin $2.6 Billion Surplus In Current Fiscal Year - MacIverInstitute

"current" - Google News

https://ift.tt/3b2HZto

https://ift.tt/3c3RoCk

Bagikan Berita Ini

0 Response to "Budget Blog: “Unprecedented” Tax Collections Give Wisconsin $2.6 Billion Surplus In Current Fiscal Year - MacIverInstitute"

Post a Comment