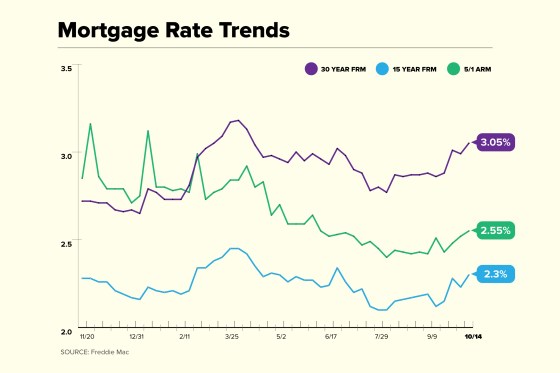

Mortgage rates jumped higher this week, with the 30-year rate increasing 0.06 percentage points compared to last week. That means the current mortgage rate for a 30-year fixed-rate loan is 3.05%, according to Freddie Mac. The average rate for a 30-year loan has not been this high since April.

The average rate for a 15-year fixed-rate loan also increased, reaching 2.3%. The rate on a 5/1 adjustable-rate mortgage moved up to 2.55%.

So you want to buy a home. Do you know how much you can afford?

Speaking to a mortgage expert will give you a better understanding of everything you need to make it a reality. Click on your state to see today’s rates.

Mortgage interest rates for the week of October 14, 2021

Mortgage rate trends

Interest rates for all loan categories are higher this week:

- The current rate for a 30-year fixed-rate mortgage is 3.05% with 0.7 points paid, an increase of 0.06 percentage points from last week. Last year, the interest rate averaged 2.81%.

- The current rate for a 15-year fixed-rate mortgage is 2.30% with 0.7 points paid, 0.07 percentage points higher than last week. A year ago, the 15-year rate was 2.35%.

- The current rate on a 5/1 adjustable-rate mortgage is 2.55% with 0.2 points paid, up 0.03 percentage points week-over-week. A year ago, the 5/1 ARM rate was 2.90%.

“The 30-year fixed-rate mortgage rose to its highest point since April,” said Sam Khater, Freddie Mac’s chief economist in a statement. “As inflationary pressure builds due to the ongoing pandemic and tightening monetary policy, we expect rates to continue a modest upswing. Historically speaking, rates are still low, but many potential homebuyers are staying on the sidelines due to high home price growth. Rising mortgage rates combined with growing home prices make affordability more challenging for potential homebuyers.”

Today’s mortgage rates and your monthly payment

The rate on your mortgage makes a big difference in how much home you can afford and the size of your monthly payments.

If you bought a $250,000 home and made a 20% down payment — $50,000 — you would end up with a starting loan balance of $200,000. On a $200,000 home loan with a fixed rate for 30 years:

- At 3% interest rate = $843 in monthly payments (not including taxes, insurance, or HOA fees)

- At 4% interest rate = $955 in monthly payments (not including taxes, insurance, or HOA fees)

- At 6% interest rate = $1,199 in monthly payments (not including taxes, insurance, or HOA fees)

- At 8% interest rate = $1,468 in monthly payments (not including taxes, insurance, or HOA fees)

You can experiment with a mortgage calculator to find out how much a lower rate or other changes could impact what you pay.

Other factors that determine how much you’ll pay each month include:

- Loan Term: Choosing a 15-year mortgage instead of a 30-year mortgage will increase monthly mortgage payments but reduce the amount of interest paid throughout the life of the loan.

- Fixed vs. ARM: The mortgage rates on adjustable-rate mortgages reset regularly (after an introductory period) and monthly payments change with it. With a fixed-rate loan payments remain the same throughout the life of the loan.

- Taxes, HOA Fees, Insurance: Homeowners insurance premiums, property taxes and homeowners association fees are often bundled into your monthly mortgage payment. Check with your real estate agent to get an estimate of these costs.

- Mortgage Insurance: Mortgage insurance costs up to 1% of your home loan’s value per year. Borrowers with conventional loans can avoid private mortgage insurance by making a 20% down payment or reaching 20% home equity. FHA borrowers pay a mortgage insurance premium throughout the life of the loan.

- Closing Costs: Some buyers finance their new home’s closing costs into the loan, which adds to the debt and increases monthly payments. Closing costs generally run between 2% and 5% and the sale prices.

There’s never been a better time to buy a home.

Mortgage Experts can help you get there. Click below and request your free quote today.

The latest information on current mortgage rates

Will current mortgage rates last?

Mortgage rates saw some movement this week, jumping back above 3%. This seems to be in part a response to minutes from the Federal Reserve’s September meeting, which indicated economic conditions are nearing the point policymakers see as necessary to start tapering purchases of Treasury and mortgage-backed securities. This program has helped keep rates low since the start of the coronavirus pandemic last year.

Although there may be volatility in rates over the next few weeks, the most mortgage experts expect a slow increase throughout the remainder of the year. Still, rates should stay very low compared to prior years.

On Thursday, the yield on the 10-year Treasury note opened at 1.547%, just a tad lower than Wednesday’s close of 1.549%. However, yields moved kept sliding this morning, moving down to 1.533% earlier today. There tends to be a spread of about 1.8 percentage points between the 10-year Treasury and average mortgage rates. This suggests rates could go higher.

How are mortgage rates impacting home sales?

The total number of mortgage applications ticked up by 0.2% for the week ending October 8, according to the Mortgage Bankers Association, as an increase in purchase loan applications helped offset a decline in refinance loans.

- The number of purchase applications increased by 2% week-over-week. Compared to the same week last year, however, applications were down by 10%.

- Refinance applications were 1% lower than the previous week and down by 16% year-over-year.

“The increase in purchase applications was welcome news, but was primarily driven by a 2% gain in conventional purchase applications, which kept the average loan size elevated,” said Joel Kan, MBA’s Associate vice president of economic and industry forecasting in a statement. “We continue to expect weakening refinance activity as rates move higher and borrowers see less of a rate incentive.”

Data based on US mortgage loans closed on Oct 13, 2021

15 YEAR FIXED CONVENTIONAL

- Oct 13: 2.54%

- Last Week: 2.49%

- Change: 0.05%

30 YEAR FIXED CONVENTIONAL

- Oct 13: 3.49%

- Last Week: 3.41%

- Change: 0.08%

7/1 ARM RATE

- Oct 13: 3.48%

- Last Week: 2.88%

- Change: 0.6%

10/1 ARM RATE

- Oct 13: 3.86%

- Last Week: 3.77%

- Change: 0.09%

Current Mortgage Rates Guide

What is a good interest rate on a mortgage?

Today’s mortgage rates are near historic lows. Freddie Mac’s average rates show what a borrower with a 20% down payment and a strong credit score might be able to get if they were to speak to a lender this week. If you are making a smaller down payment, have a lower credit score or are taking out a non-conforming (or jumbo) mortgage, you may see a higher rate. A good mortgage rate is one where you can comfortably afford the monthly payments and where the other loan details (such as the length of the loan, whether the rate is fixed or adjustable and other fees) fit your needs.

How much does the interest rate affect mortgage payments?

In general, the lower the interest rate the lower your monthly payments will be. For example —

- If you have a $300,000 fixed-rate 30-year mortgage at 4% interest, your monthly payment will be $1,432 (not including property taxes and insurance). You’ll pay a total of $215,608 in interest over the full loan term.

- The same-sized loan at 3% interest will have a monthly payment of $1,264. You will pay a total of $155,040 in interest — a savings of over $60,000.

You can use a mortgage calculator to determine how different mortgage rates and down payments will affect your monthly payment. Consider steps for improving your credit score in order to qualify for a better rate.

How are mortgage rates set?

Lenders use a number of factors to set prevailing rates each day. Every lender’s formula will be a little different but will take into account things like the current Federal Funds rate (a short-term rate set by the Federal Reserve), competitor rates and even how much staff they have available to underwrite loans.

In general, rates track the yields on the 10-year Treasury notes. Average mortgage rates are usually about 1.8 percentage points higher than the yield on the 10-year note. Yields matter because lenders don’t keep the mortgage they originate on their books for long. Instead, in order to free up money to keep originating more loans, lenders sell their mortgages to entities like Freddie Mac and Fannie Mae. These mortgages are then packaged into what are called mortgage-backed securities and sold to investors. Investors will only buy if they can earn a bit more than they can on the government notes.

Why is my mortgage rate higher than average?

Not all applicants will receive the very best rates when taking out a new mortgage or refinancing. Credit scores, loan term, interest rate types (fixed or adjustable), down payment size, home location and the loan size will all affect mortgage rates offered to individual home shoppers.

Rates also vary between mortgage lenders. It’s estimated that about half of all buyers only look at one lender, primarily because they tend to trust referrals from their real estate agent. Yet this means that they may miss out on a lower rate elsewhere.

Freddie Mac estimates that buyers who got offers from five different lenders averaged 0.17 percentage points lower on their interest rate than those who didn’t get multiple quotes. If you want to find the best rate and term for your loan, it makes sense to shop around first.

Should you refinance your mortgage when interest rates drop?

Determining whether it’s the right time to refinance your home loan or not involves a number of factors. Most experts agree you should consider refinancing if your current mortgage rate exceeds today’s mortgage rates by 0.75 percentage points. It doesn’t make sense to refinance every time rates decline a little bit because mortgage fees would cut into your savings. You also have to consider whether your credit score would qualify you for today’s best refinance rates.

Many online lenders can give you free rate quotes to help you decide whether the money you’d save in interest charges justifies the cost of a new loan. Try to get a quote with a soft credit check which won’t hurt your credit score.

You could enhance interest savings by going with a shorter loan term such as a 15-year mortgage. Your payments may be higher, but you could save in interest charges over time and you’d pay off your house sooner.

Summary of current mortgage rates

Current mortgage rates are higher today, with the 30-year mortgage rate increasing 0.06 percentage points from last week. Both the 15-year fixed-rate and 5/1 adjustable-rate mortgages are also seeing higher rates.

- The current rate for a 30-year fixed-rate mortgage is 3.05% with 0.7 points paid, an increase of 0.06 percentage points from last week. Last year, the interest rate averaged 2.81%.

- The current rate for a 15-year fixed-rate mortgage is 2.30% with 0.7 points paid, 0.07 percentage points higher than last week. A year ago, the 15-year rate was 2.35%.

- The current rate on a 5/1 adjustable-rate mortgage is 2.55% with 0.2 points paid, up 0.03 percentage points week-over-week. A year ago, the 5/1 ARM rate was 2.90%.

© Copyright 2021 Ad Practitioners, LLC. All Rights Reserved.

This article originally appeared on Money.com and may contain affiliate links for which Money receives compensation. Opinions expressed in this article are the author’s alone, not those of a third-party entity, and have not been reviewed, approved, or otherwise endorsed. Offers may be subject to change without notice. For more information, read Money’s full disclaimer.

"current" - Google News

October 15, 2021 at 12:56AM

https://ift.tt/2YLUBom

Current Mortgage Rates Move Back Above 3% - Crossroads Today

"current" - Google News

https://ift.tt/3b2HZto

https://ift.tt/3c3RoCk

Bagikan Berita Ini

0 Response to "Current Mortgage Rates Move Back Above 3% - Crossroads Today"

Post a Comment