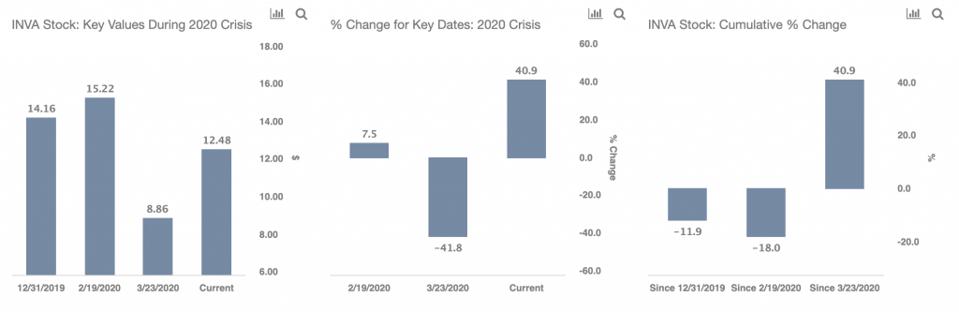

We believe that Innoviva stock (NASDAQ: INVA), a pharmaceuticals royalty management company, is a good buying opportunity at the present time. INVA stock trades near $12 currently and it is, in fact, down 17% from its pre-Covid high of $15 in February 2020 – just before the coronavirus pandemic hit the world. INVA stock has rallied 54% since its March lows of $8, compared to 65% gains for the S&P 500. The underperformance can largely be attributed to lower than estimated Q3 revenue and earnings. Looking forward, with economies opening up gradually, the company will likely see improved sales growth, driving the stock higher from here, in our view. We compare Innoviva stock performance during the current financial crisis with that during the 2008 recession in our interactive dashboard.

2020 Coronavirus Crisis

Timeline of 2020 Crisis So Far:

- 12/12/2019: Coronavirus cases first reported in China

- 1/31/2020: WHO declares a global health emergency.

- 2/19/2020: Signs of effective containment in China and hopes of monetary easing by major central banks helps S&P 500 reach a record high

- 3/23/2020: S&P 500 drops 34% from the peak level seen on Feb 19, as COVID-19 cases accelerate outside China. Doesn’t help that oil prices crash in mid-March amid Saudi-led price war

- Since 3/24/2020: S&P 500 recovers 66% from the lows seen on Mar 23, as the Fed’s multi-billion dollar stimulus package suppresses near-term survival anxiety and infuses liquidity into the system.

In contrast, here is how INVA stock and the broader market fared during the 2007-08 crisis

Timeline of 2007-08 Crisis

- 10/1/2007: Approximate pre-crisis peak in S&P 500 index

- 9/1/2008 – 10/1/2008: Accelerated market decline corresponding to Lehman bankruptcy filing (9/15/08)

- 3/1/2009: Approximate bottoming out of S&P 500 index

- 12/31/2009: Initial recovery to levels before accelerated decline (around 9/1/2008)

INVA and S&P 500 Performance Over 2007-08 Financial Crisis

INVA stock declined from levels of about $21 in August 2008 (pre-crisis peak) to levels of $11 in March 2009 (as the markets bottomed out), implying INVA stock lost 47%. It failed to recover immediately post the 2008 crisis, and it fell by another 6% to levels of $10 by January 2010. In comparison, the S&P 500 Index saw a decline of 51% from its peak in September 2007 to its bottom in March 2009, followed by a sharp recovery of 48% by January 2010.

Innoviva Fundamentals Over Recent Years Have Been Robust

Innoviva’s revenues increased from $134 million in 2016 to $261 million in 2019, led by an increase in royalty revenues from Relvar (asthma treatment). The company has also seen its Net Margins expand from 44% to 60% on GAAP basis, aiding its EPS, which grew from $0.54 to $1.89 over the same period. More recently, Innoviva garnered over $246 million in total revenue, reflecting 33% growth y-o-y for the nine months period ending September 2020. The growth was primarily led by increased contribution of royalties from Relvar. Looking at the bottom line, the company reported consolidated EPS of $1.68 for the first 3 quarters of 2020, compared to a $1.10 figure in the prior year period.

Does Innoviva Have Sufficient Cash Cushion To Meet Its Obligations Through The Coronavirus Crisis?

Innoviva total debt decreased from $708 million in 2016 to $383 million at the end of Q3 2020, while its total cash increased from $150 million to $479 million over the same period. Innoviva also generated $228 million cash from operations in the first nine months of 2020. The company has a strong liquidity cushion to weather the current crisis.

Conclusion

Phases of Covid-19 Crisis:

- Early- to mid-March 2020: Fear of the coronavirus outbreak spreading rapidly translates into reality, with the number of cases accelerating globally

- Late-March 2020 onward: Social distancing measures + lockdowns

- April 2020: Fed stimulus suppresses near-term survival anxiety

- May-June 2020: Recovery of demand, with gradual lifting of lockdowns – no panic anymore despite a steady increase in the number of cases

- July-October 2020: After poor Q2 results, Q3 expectations were lukewarm, but continued improvement in demand, and progress with vaccine development buoyed market sentiment.

As the global economy opens up and lockdowns are lifted in phases, consumer demand is expected to pick up. This could be reflected in the form of an increase in hospital visits and total revenues toward the end of 2020, followed by continued revenue growth in 2021, boding well for INVA stock in the near term. We believe that INVA stock could rally back to its pre-Covid levels of $15, implying over 25% upside from the current levels.

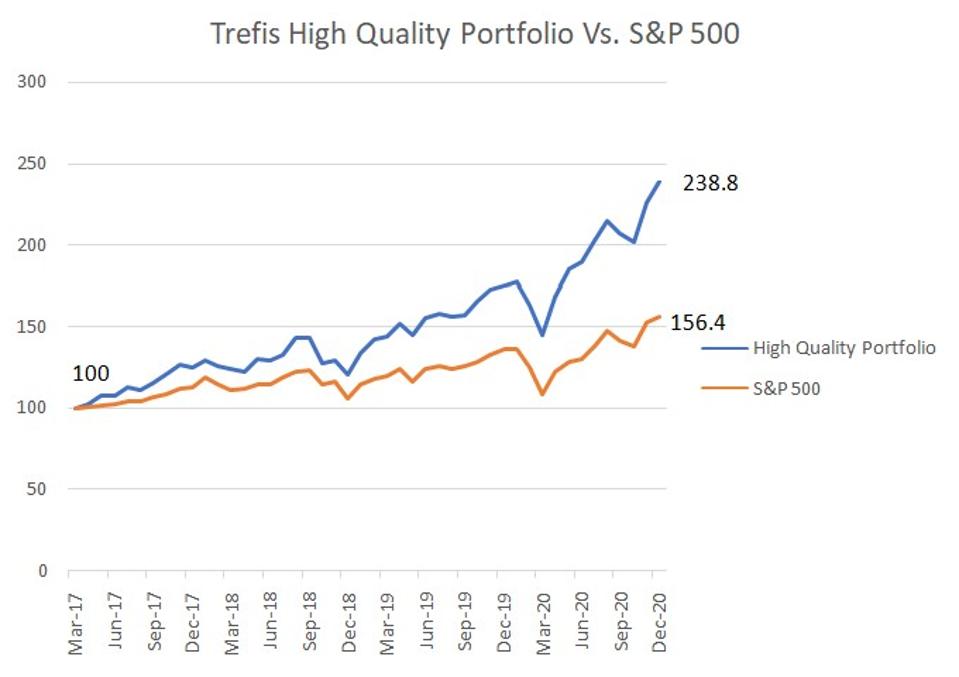

Trefis

What if you’re looking for a more balanced portfolio instead? Here’s a high-quality portfolio to beat the market, with over 100% return since 2016, versus 55% for the S&P 500. Comprised of companies with strong revenue growth, healthy profits, lots of cash, and low risk, it has outperformed the broader market year after year, consistently.

See all Trefis Price Estimates and Download Trefis Data here

What’s behind Trefis? See How It’s Powering New Collaboration and What-Ifs For CFOs and Finance Teams | Product, R&D, and Marketing Teams

"current" - Google News

December 24, 2020 at 07:30PM

https://ift.tt/3aJCpzB

Innoviva Can Offer 25% Upside From Current Levels - Forbes

"current" - Google News

https://ift.tt/3b2HZto

https://ift.tt/3c3RoCk

Bagikan Berita Ini

0 Response to "Innoviva Can Offer 25% Upside From Current Levels - Forbes"

Post a Comment